Overview

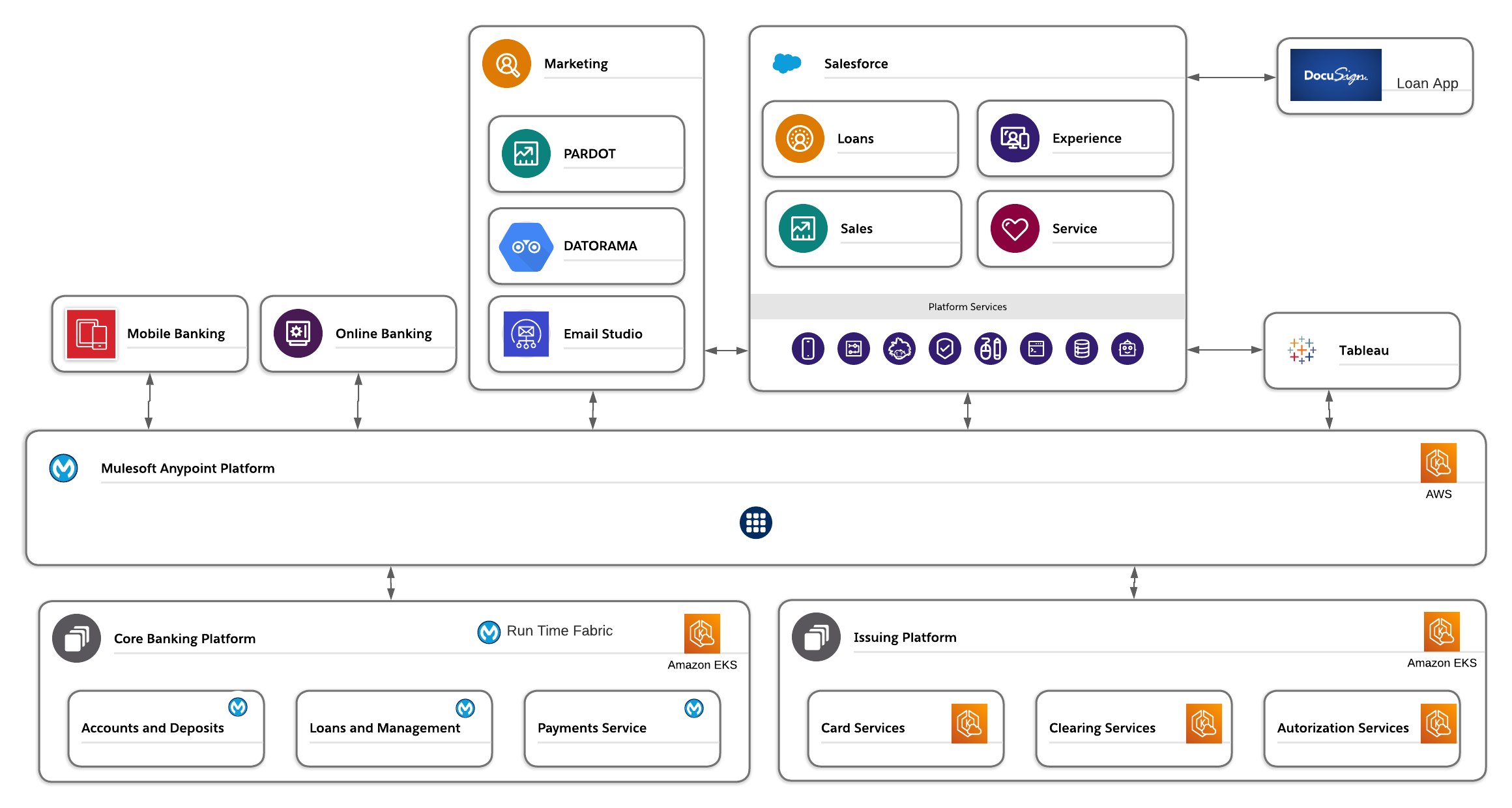

Built an integrated banking platform that connected customer experience systems (Salesforce), digital channels (mobile/web), and backend processing platforms (core banking, card issuing) via Mulesoft APIs and AWS services. This modern architecture enabled real-time servicing of loans, deposits, card issuance, and omnichannel marketing with enterprise-level scalability and observability.

Platform Services

- Connected Salesforce modules: Sales, Service, Loans, Experience Cloud

- Embedded marketing suite: Pardot, Datorama, and Email Studio for campaign tracking and activation

- Reporting and business insights via Tableau and AWS-hosted data sources

Integration Architecture

- Central integration layer built with Mulesoft Anypoint Platform

- APIs exposed to mobile and online banking channels with token-based OAuth auth

- Backend systems (Deposits, Loans, Payments) deployed on Amazon EKS and Mulesoft Runtime Fabric

- Issuing services for Cards, Authorization, and Clearing also hosted on AWS with service auto-scaling

- Connected with DocuSign for digital loan signing and lifecycle status updates

Architecture Diagram: Mulesoft integration, Salesforce clouds, EKS-hosted banking modules, and analytics overlay

Key Capabilities

- End-to-end account opening, KYC processing, and card provisioning from mobile device to core banking

- Event-driven updates from backend services to Salesforce to maintain engagement touchpoints

- Real-time updates and dashboards for agents, managers, and customers

Strategic Benefits

Business Impact

Reduced servicing cost per customer interaction

Unified customer view with automated data flows

Improved marketing ROI by tailoring campaigns to transactional events

What Set It Apart

- Strong orchestration between frontend channels and backend services

- Reusable APIs and scalable messaging between clouds

- Built for secure, scalable digital transformation